VIRTUAL TOURS | 360° PHOTOGRAPHY | CINEMATIC VIDEO

Elevate Real Estate Listings to the

Next Level .

Interactive digital walkthrough tours, premium panoramic photography,

and cinematic video production.

VIRTUAL PROPERTY TOURS | 360° PHOTOGRAPHY | CINEMATIC VIDEO

Elevate your Real Estate Listings to the Next Level .

Interactive digital walkthrough tours,

premium panoramic photography,

and cinematic video production.

VIRTUAL TOURS | 360° PHOTOGRAPHY | CINEMATIC VIDEO

Elevate your Real Estate Listings to the Next Level .

Interactive digital walkthrough tours, premium panoramic photography,

and cinematic video production.

Premium Virtual Tours

Premium Virtual Tours

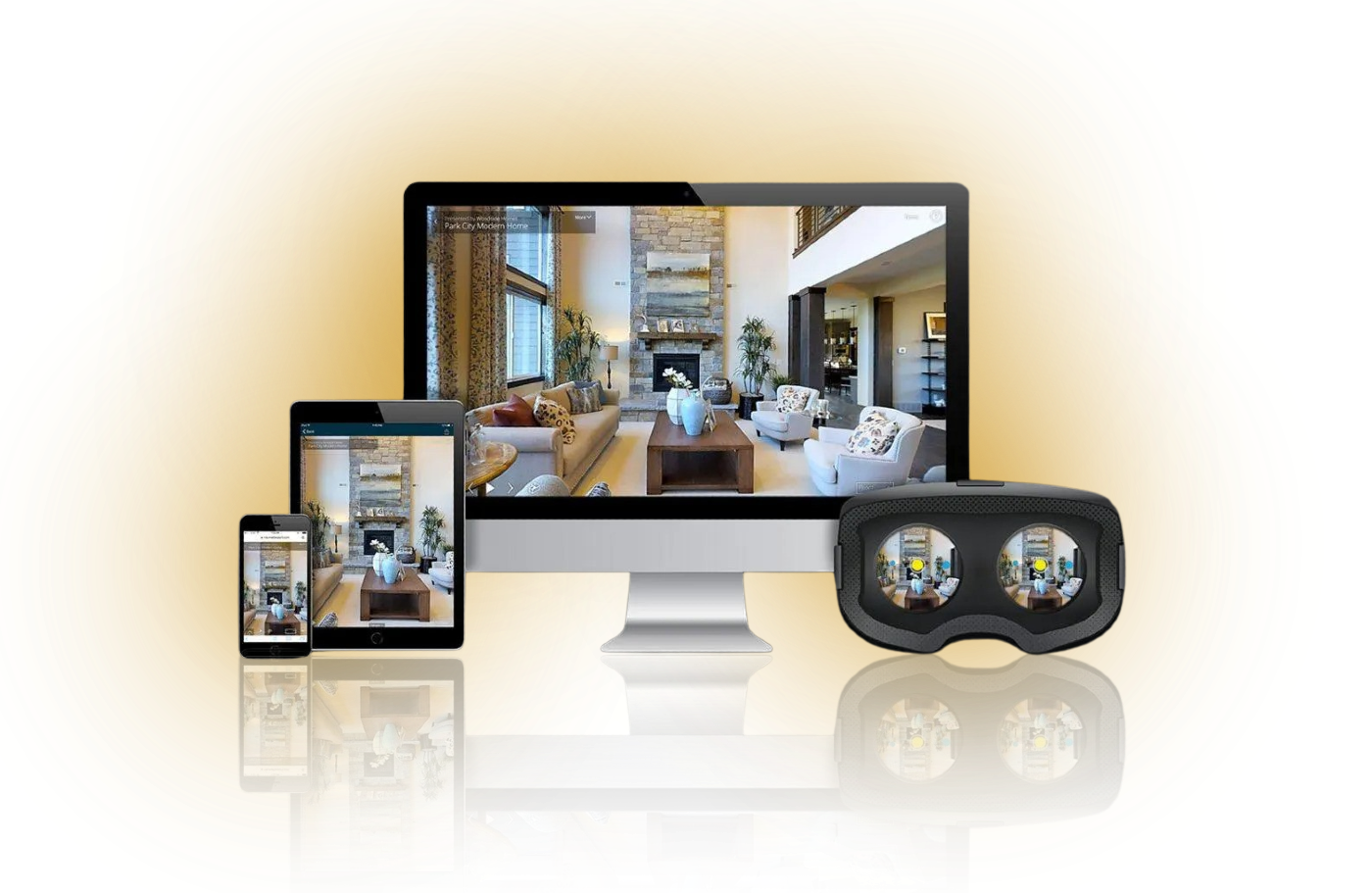

Engage potential buyers with a digital interactive property tour delivered as an easily shareable link.

Engage potential buyers with a digital interactive property tour delivered as an easily shareable link.

360° Photography

360° Photography

Capture the entire essence of your property through panoramic photos showing all amenities in full view.

Capture the entire essence of your property through panoramic photos showing all amenities in full view.

.

Listings with a

virtual tour receive... 87%

...more views compared

to property listings

with only photos.

- Realtor.com

Create an Immersive Experience for Clients...

Create an Immersive Experience for Buyers...

SILVER PACKAGE

Perfect for a basic virtual tour of a residential listing or another property location.

What's Included:

★ 360° scan of a property up to 2000 sq ft.

★ Creation and review of your 3D virtual tour.

★ Basic editing to enhance lighting & colors.

★ Delivery of the virtual tour link for easy sharing.

★ Add On + square footage for $. 15 per sq ft.

★ Add On + 2 min video walkthrough for + $99.

$99

(plus tax)

GOLD PACKAGE

GOLD PACKAGE

The ultimate package for a medium sized residential or commercial space to provide an enhanced viewing experience.

What's Included:

★ 360° scan of a property 2000 - 3000 sq ft.

★ Creation and review of your 3D virtual tour.

★

Advanced editing to enhance lighting & colors.

★ Delivery of the virtual tour link for easy sharing.

★ 2 Minute Cinematic Property Highlight Video

★ Add On + square footage for $. 15 per sq ft.

$249

(plus tax)

DIAMOND PACKAGE

Ideal for larger or higher-end residential and commercial properties.

What's Included:

★ 360° scan of a property 3000 - 4000 sq ft.

★ Creation and review of your 3D virtual tour.

★ Advanced editing to enhance lighting & colors.

★ Delivery of the virtual tour link for easy sharing.

★ 2 Minute Cinematic Property Highlight Video

★ Add On + square footage for $. 15 per sq ft.

$349

(plus tax)

HOW IT WORKS

WE SCAN / SHOOT

Upon scheduling, we will visit your property location equipped with a Ricoh 360 camera and 4K DJI Video Camera to meticulously scan/film the entire space.

WE SCAN / SHOOT

Upon scheduling, we will visit your property location equipped with a Ricoh 360 camera and 4K DJI Video Camera to meticulously scan/film the entire space.

WE EDIT & DELIVER

Once the photos/videos are uploaded and processed, our post-production team will craft the virtual tour to ensure a perfect experience. You'll receive a link for accessing your 3D Tour or for embedding it online.

WE EDIT & DELIVER

Once the photos/videos are uploaded and processed, our post-production team will craft the virtual tour to ensure a perfect experience. You'll receive a link for accessing your 3D Tour or for embedding it online.

YOU SHARE

Easily share via email or SMS, distribute across marketing channels, or seamlessly integrate into your website. The options are limitless, plus, no downloads or plug-ins required for online distribution.

YOU SHARE

Easily share via email or SMS, distribute across marketing channels, or seamlessly integrate into your website. The options are limitless, plus, no downloads or plug-ins required for online distribution.

Testimonials...

Jane Doe

Executive Director

Coming Soon...

John Doe

Assistant to the Manager

Coming Soon...

Jon Dough

Head Baker

We've Got You Covered . . .

We've Got You

Covered . . .

CONTACT US

Get in Touch.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Or send us a message at

CONTACT US

Get in Touch.

Contact Us

We will get back to you as soon as possible.

Please try again later.